Investor's Guide for Electricity

Since the beginning of 2020, the world has entered into a heightened period of volatility, uncertainty, complexity and ambiguity due to the COVID-19 pandemic. This new period requires uninterrupted flow of energy and market stability more than ever with increasing digitalization and home-based work. Further, the record-breaking surge in electricity, gas and coal prices are threatening the energy markets and post-COVID-19 recovery process for the world. As Türkiye, we felt the necessity to maintain and strengthen the resilience of the energy sector rapidly. There has been a greater need to adjust our energy policies, products and services to the new normal with a global vision in accordance with a sustainable environment characterized by the Paris Agreement.

Türkiye’s energy sector is in a transition to ensure self-reliance, robustness, diversification, supply security, competitiveness, environment-friendly low-carbon energy in compliance with its national circumstances as committed by the Treaty of Paris. So far, the sector has been driven by two major characteristics: growing energy demand and import dependency, both of which are impacted by steady economic development with averagely 5% annual growth coupled with sectoral leaps in energy. To tackle these challenges, Türkiye has had its own circumstantial energy transition phases, first of which lasted a decade over the period of 2001-2016. During this first stage, Türkiye introduced radical reforms and restructuring in the energy sector including independent regulation of the sector by the Energy Market Regulatory Authority, enabling a level playing field for new market entrants, liberalization in power generation, distribution and trade as well as gas distribution and retail, and stepping up efforts to support the growth of renewable energy sources like solar and wind. Ensuring non-discriminatory access to energy markets mobilized sizeable private sector investments and involvement in energy activities. Since then the installed capacity in energy generation, for instance, has almost tripled and the energy landscape in Türkiye’s consumption and power generation patterns have altered.

Having reached a certain maturity threshold with the introduction of the Energy Exchange Istanbul (EXIST) for electricity and natural gas transactions, Türkiye has stepped into the second phase of the energy transition which is mainly inspired by the National Energy and Mining Policy Strategy announced in 2017. This new stage emphasizes the three main pillars of the Strategy, which are (i) reinforcement of security of supply, (ii) localization through renewable and domestic sources and (iii) enhancement of predictability in the market. Cross-cutting these pillars; market reforms, utilization of renewable resources, improvement of energy efficiency, deployment of new technologies and new infrastructure investments are the main objectives of our policy. This Strategy introduced a new framework for conceptualizing the progress we have already achieved long ago into a more structured and clearer pathway.

The third step can be considered as Türkiye's ratification of the Paris Agreement and the acceleration of its work by determining policies compatible with its green transition vision. At this stage, our country will take firm steps towards becoming a carbon neutral market economy in line with the 2050 targets.

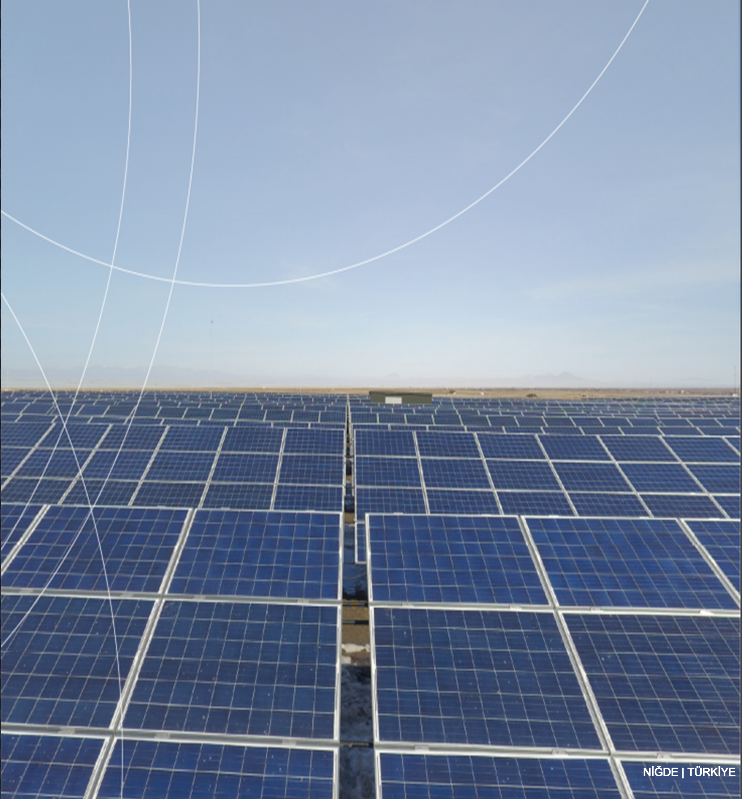

Türkiye continues to be an island of stability and growth with nearly 5,5% annual economic growth between 2002-2020. Moreover, Türkiye has become the fastest growing economy among the OECD countries in 2021 with an economic growth of 11%. During this economic boom period, electricity sector has gone through a reform and restructuring process. In the light of the positive track record we have achieved in all sub-sectors of the energy sector including electricity, Türkiye has achieved remarkable progress in creating a regulatory framework with a transparent and competitive market structure in convergence with EU markets. Political stability and good governance have eased the movements of private sector investments in the field of energy. In this context, the Ministry of Energy and Natural Resources issued a regulation commissioning large-scale renewable energy projects in Renewable Energy Zones (REZ). The first REZ tender was awarded in May 2017 for the construction of a 1 GW solar power plant (SPP) with an estimated USD 1.3 billion total investment. Besides, Türkiye’s first integrated solar panel manufacturing facility, the first and only in Europe and the Middle East, went into operation in August 2020. Furthermore, the REZ Wind Power Plant (WPP)-1 Competition held in 2017 with a connection capacity of 1000 MW was allocated. In 2019, REZ WPP-2 Competitions, with a total capacity of 1000 MW for four different regions each with a capacity of 250 MW, were also held. In 2021, new solar tenders which include 74 auctions in 36 cities with the capacities of 10, 15 and 20 MW, total installed capacity of 1 GW, were completed. Moreover, three different REZ tenders for 2200 MW of solar 850 MW of wind energy were announced in Official Gazette.

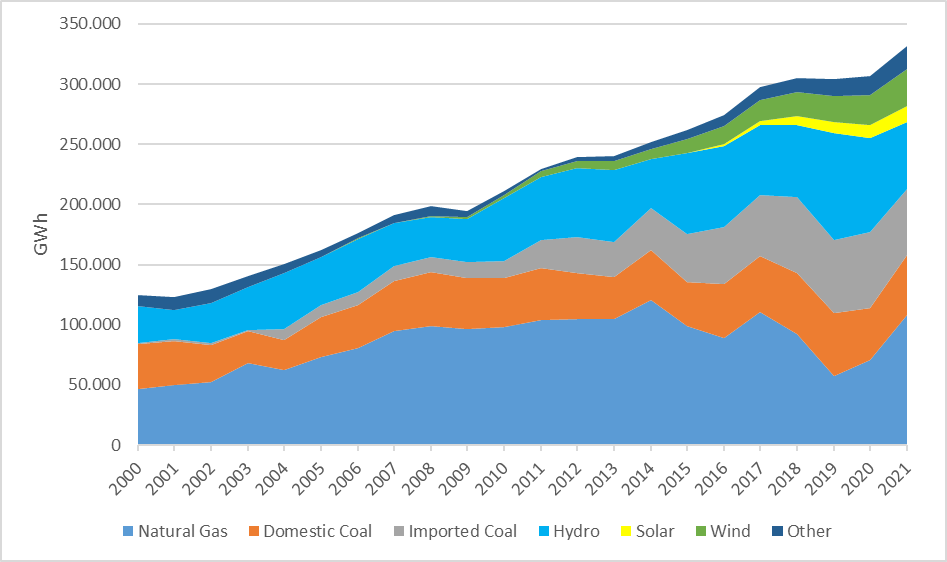

Electricity consumption in 2021 increased by 7.7% compared to 2020. Strong economic recovery following COVID 19 pandemic is one of the main reasons for the relatively high growth in electricity consumption.

In 2021, Türkiye has continued to be a safe harbor and a leading actor in its region for further investments, especially by approving Paris Agreement. In line with this objective, we, as the Ministry of Energy and Natural Resources, published the Investor’s Guide in the last quarter of 2018, 2019, 2020 and 2021 thanks to the high attention it has attracted.

Taking this opportunity, I would like to invite all investors to take part in Türkiye’s lucrative energy sector.

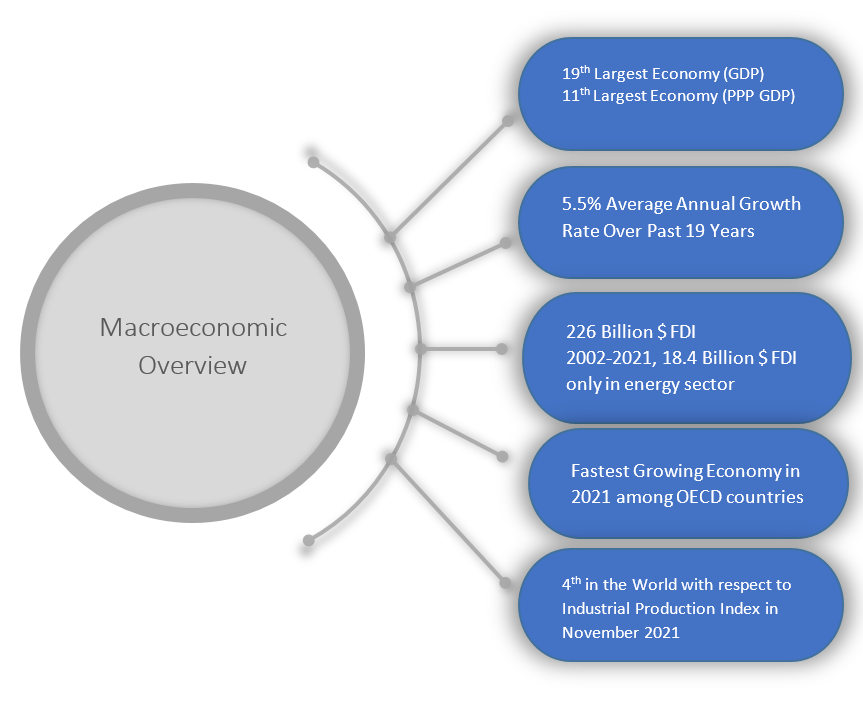

Türkiye’s Macroeconomic Overview

Over the past decade, Türkiye has emerged as a strong regional player with global ambitions to be one of the top 10 economies in the world. As of end-2020, Türkiye is the 11th largest economy (GDP at PPP terms) in the world, with an impressive annual growth rate of 5.5% in the 2002-2021 period. Moreover, Türkiye has become the fastest growing economy among the OECD countries in 2021 with an economic growth of 11%. Strong market fundamentals such as a young and dynamic population with an average age of 33.1, a well-educated work force, increasing rates of employment over the years, a growing middle-class, and a unique geographical location, have all helped transform Türkiye into one of the fastest growing and outstanding economies in the world.

Türkiye is taking actions to improve its economic fundamentals. For instance, a series of government measures is set to reduce the current account deficit, with one such measure being that international investments can be used as leverage to support the localization of technologies and products. In addition, in priority sectors where Türkiye is dependent on imports of intermediate goods, international companies are being attracted to the country to produce these goods locally.

An example of this is the energy sector, which had a very high external dependence a decade ago. With the implementation of various measures, it is expected that the localization rate in the sector could rise to over 65% in the coming 5 to 10 years.

Türkiye enacted the Foreign Direct Investment Law (FDI) in 2003 enshrining equal treatment for all investors, both foreign and domestic, and providing them with certain guarantees such as international arbitration, guarantee of profit transfer and protection against expropriation. The economic development and structural reforms have made Türkiye one of the most attractive destinations for FDI. FDI inflow to Türkiye amounted to over USD 240 billion in the 2002-2021 period. In the same period, all FDI inflow to the energy sector stood at about USD 18.4 billion. Similarly, the number of companies with foreign capital in Türkiye reached 76,741 in 2021, up from 5,600 in 2002.

Demand for energy and natural resources has been increasing due to economic and population growth in Türkiye. In recent years, Türkiye has seen the fastest growth in electricity demand among OECD members, with an annual growth rate of about 5% since 2002. Türkiye will increase its energy use by about 50% over the next decade. Morever, the Ministry of Energy and Natural Resources (MENR) confirms that this trend will continue in the long term.

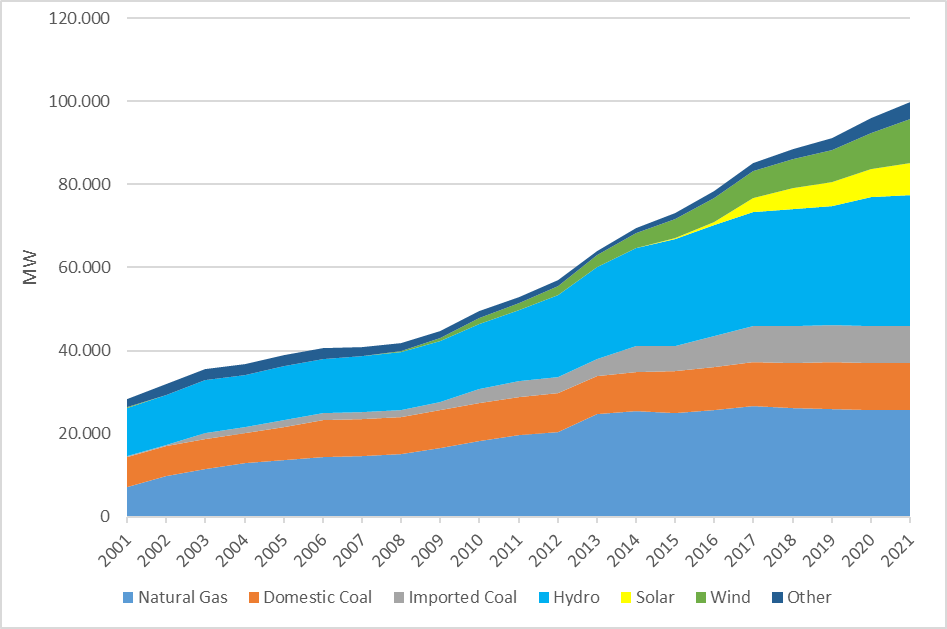

Türkiye’s installed capacity has reached 95.9 GW in 2020 and 99.8 GW in December 2021. Türkiye has achieved an additional capacity increase of 4.2 GW in 2021. In terms of the volume of traded electricity, Türkiye is the 3rd largest spot electricity market in Europe.

Installed Capacity (Breakdown by Sources in Türkiye)

Electricity Generation (Breakdown by Sources in Türkiye)

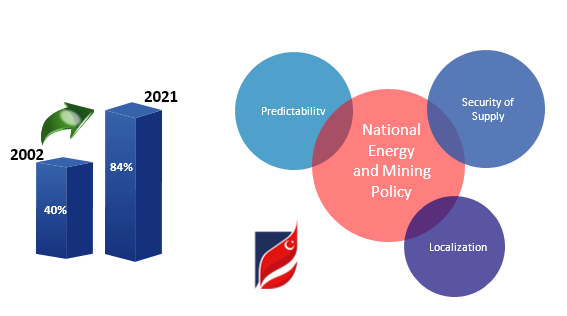

SHARE OF PRIVATE SECTOR IN ELECTRICITY GENERATION

The majority of the capacity additions in Türkiye has been realized in the last 15 years as a result of the private sector investments. The share of private sector in electricity generation rose from 40% in 2002 to 84 % in 2021, along with the shrinking share of Build-Operate and Build-Operate-Transfer power plants during the period.

In light of these developments, Türkiye announced the National Energy and Mining Policy in 2017 in order to increase the confidence in the energy sector and to update its targets. Ensuring security of supply, localization, and predictable market conditions are the main pillars of this policy. The top priority for Türkiye is to decrease its import dependency by utilizing its domestic and renewable energy sources and to add nuclear power to its energy mix. Furthermore, utilizing domestic and renewable energy potential is coupled with incentivizing local manufacturing of equipment, an example of which is the additional incentives for locally manufactured renewable energy equipment.

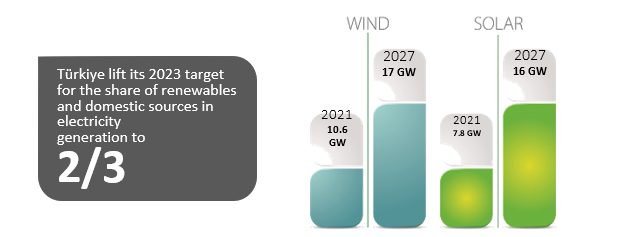

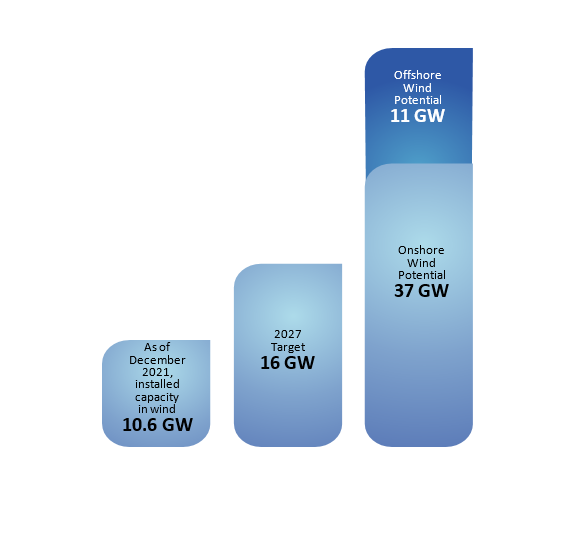

Türkiye has substantial amount of renewable energy potential, and the utilization of this potential has been increasing over the last decade. As of end of 2021, hydro and wind resources constitute the vast majority of Türkiye’s renewable energy capacity, accounting for 31.5 GW and 10.6 GW respectively of the total installed capacity of 99.8 GW. Furthermore, Türkiye’s target is to add around 10 GW of new solar and wind capacity by 2026 compared to the 2016 baseline.

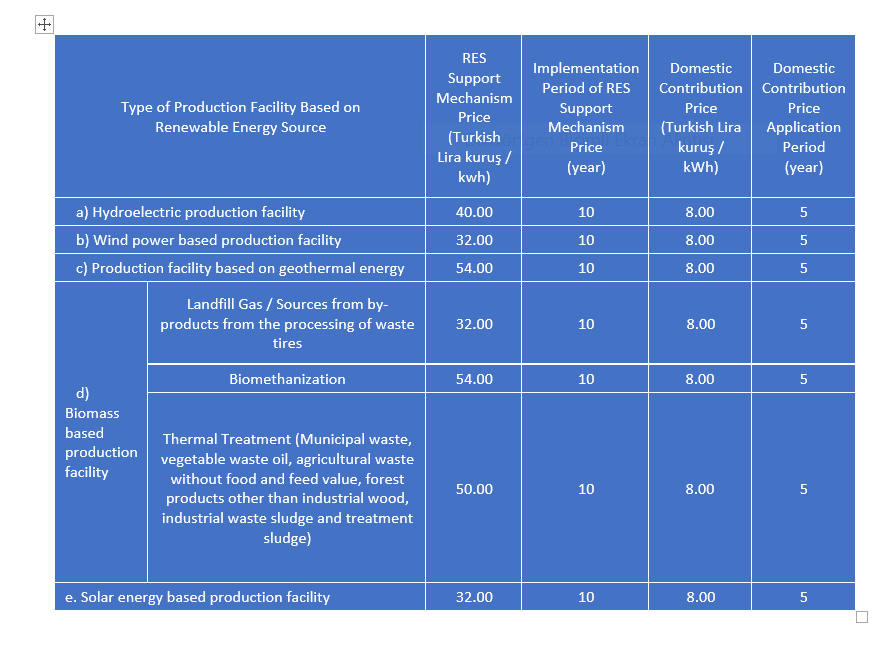

Additionally, Türkiye aims to increase the share of domestic and renewable energy in power generation capacity to 2/3 by 2023. Renewable Energy Zones model was created for this purpose. Furthermore, a feed-in tariff mechanism (YEKDEM) is currently in place which has been redesigned on 30th of January, 2021 for the period from July 1st of 2021 to December 31th of 2025.

The prices which are given below are applied for the periods specified afront side, for electricity generation facilities based on renewable energy resources with RES Certificate which will be commissioned from 1/7/2021 until 31/12/2025.

These prices are escalated on the basis of source within a period of 3 months each year, according to Domestic Producer Price Index, Consumer Price Index, the average daily US dollar and Euro forex buying rates.

Türkiye also gives priority to the utilization of nuclear and coal resources as efficiently and environment-friendly as possible. Türkiye will continue its studies towards utilisation of domestic coal potential with clean coal technologies.

In terms of regulating nuclear energy and ensuring nuclear safety, in 1956, General Secretariat of Atomic Energy Commission was established in Ankara only to be restructured as Turkish Atomic Energy Authority (TAEK) in 1982 as the nuclear regulatory body. TAEK was responsible for ensuring nuclear safety and nuclear security by licensing and inspecting nuclear & radiation activities and facilities. In 2018, Nuclear Regulatory Authority was established to take over these duties from TAEK, leaving it in charge of only execution, coordination and support for R&D activities in the nuclear field.

In 2020, Turkish Energy, Nuclear and Mineral Research Agency-TENMAK was established. TENMAK gathered Turkish Atomic Energy Authority (TAEK), National Boron Research Institute (BOREN) and Rare Earth Element Research Institute (NATEN) under one roof. By this reorganization; TAEK, BOREN and NATEN have been closed and any referral made to TAEK, BOREN and NATEN by any entity and/or legal/legislative document is presumed to be made to TENMAK. The new agency consists of a central organization headquartered in Ankara and many service units directly connected to the headquarters.

TENMAK has been given a very powerful and stronger role with a wide operational scope and executive privileges. The overarching objective of TENMAK is published as “to serve our country and humanity & to perpetuate and increase the competitiveness of Türkiye in the fields of energy, mining, ionizing radiation, particle accelerators and nuclear technology.” TENMAK has been given the lead role, authority and responsibility on research and development in science and technology related to energy, minerals, ionizing radiation, particle accelerators, nuclear, boron and rare earth elements.

On the other hand, Türkiye has been a member of IAEA since 1957 as well as continuing the enhancement of its nuclear safety capacity by the virtue of EU’s instrument for Nuclear safety cooperation (INSC). Türkiye is sharing experience and knowledge with other countries using the international platforms such as ‘Organisation for Economic Co-operation and Develepment (OECD) – Multinational Design Evaluation Programme (MDEP)’ and VVER Forum. Such platforms help Türkiye to increase infrastructure in the basis of nuclear safety.

“The Protocol to amend the Convention on Third Party Liability in the field of Nuclear Energy of 29 July 1960 (2004 Paris Protocol) as amended by the Additional Protocol dated January 28 1964 and the Protocol dated November 16 1982” and "The Joint Convention on the Safety of Spent Fuel Management and on the Safety of Radioactive Waste Management" entered into force by being published in the Official Gazette dated October 17, 2021 and numbered 31631.

Regarding import dependency and combating climate change, Türkiye has made great progress to introduce nuclear energy into its energy mix. Accordingly, Türkiye signed an intergovernmental agreement with the Russian Federation in 2010 for the construction of a nuclear power plant with 4800 MW capacity. Technical evaluations and assessments for the second and third nuclear power plants are ongoing and the share of nuclear energy power generation in Türkiye is targeted to be around 10% in the long term.

It also worth mentioning that Türkiye’s natural gas sector has been steadily improving. Türkiye commissioned two Floating Storage Regasification Unit (FSRU) terminals in 2018. One goal is to expand Türkiye’s underground gas storage capacity to 11 bcm by 2023, up from its current capacity of 4.4 bcm. Türkiye has recently begun exploration activities in its seas with a drill ship owned by itself. Furthermore, the organized wholesale gas market operations started under Energy Exchange Istanbul (EXIST) as of 1st of September, 2019. Moreover, EXIST has launched gas futures market on the 1st of October in 2021. With futures contracts, market participants are able to manage their portfolios more flexibly and benefit from greater price.

The National Energy Efficiency Action Plan, (2017-2023) is aimed at reducing Türkiye's primary energy consumption by 14% by 2023 through 55 actions addressing the principal energy sectors namely, buildings and services, energy, transport, industry, and technology, agriculture and cross-cutting areas. In this direction, a cumulative saving of 23,9 Mtoe is projected for 2023, requiring an investment of $10.9 billion. The cumulative savings to be achieved by 2033 is $30.2 billion according to 2017 prices, with the effect of certain savings continuing until 2040.

It is calculated that between 2017 and 2020, thanks to the investments made in energy efficiency, an annual saving of $1.2 billion was achieved and additional employment for 10,687 people was created. Moreover, when taking into account its impact on sub-sectors, it created a gross added value of $3.6 billion for the economy.

Also, Türkiye made an amendment in the Energy Efficiency Law to remove the barrier in front of the implementation of Energy Performance Contracts (EPCs) in public buildings in 2018. Public buildings could sign contrats up to 15 years to improve energy efficiency in their buildings via Turkish ESCOs. EPCs are a financing mechanism based on the repayment of the initial investment costs of energy efficiency or renewable energy projects with the monetary savings to be achieved in the following years.

Turkish electricity sector has gone through a significant transformation over the last two decades. Throughout this period, electricity market underwent a liberalization process along with the establishment of a regulatory authority for energy sector. Turkish electricity market went through many reforms, and became a functional electricity market with large-scale private sector participation following privatization.

Seeking to become a full member of the European Union, Türkiye took the initiative to open its electricity market to competition in 2001. This marked a turning point for Türkiye, as the design and legal framework of the new market were adapted from those of the European Union. Since 2001, there have been some major developments in the market. In 2013, the new Electricity Market Law No. 6446 was published and privatization process of 21 distribution companies were completed. English translation of the electricity market legislation is available at EXIST Website.

Drawing upon these developments, trial synchronous parallel operation of the Turkish Power System with the ENTSO-E Continental Europe Synchronous Area (CESA) began in 2010. Following the fullfilment of ENTSO-E’s standards/obligations by Turkish Electricity Transmission Corporation (TEIAS), the Long-Term Agreement was signed in April 2015 and revised in April 2021 that turned TEIAS into an integral part of European network. The Observership Agreement was signed between TEIAS and ENTSO-E on January 14, 2016 for a 3 years duration and negotiations for the renewal of the Observership Agreement is ongoing.

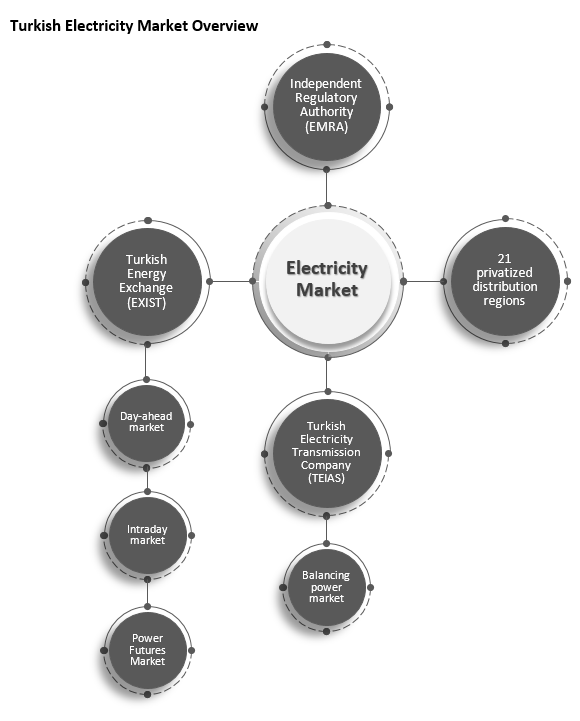

Turkish Electricity Market Overview

Energy Market Regulatory Authority

Energy Market Regulatory Authority (EMRA) was established in 2001 in order to perform the regulatory and supervisory functions in the energy markets. The fundamental objective of EMRA is to ensure the development of financially sound and transparent energy markets operating in a competitive environment. It is also EMRA’s responsibility to maintain the delivery of sufficient, high-quality, low-cost and environment-friendly energy to consumers and to ensure the autonomous regulation, licensing and supervision of electricity, natural gas, and downstream petroleum and LPG markets.

Energy Exchange Istanbul (EXIST) or “Enerji Piyasaları İşletme A.Ş.” by its Turkish name is an energy exchange company was established on March 12, 2015. Energy Exchange Istanbul currently operates electricity and natural gas markets. It is also in charge of settlement of the balancing power market, ancillary services market, the system imbalances and YEKDEM (Renewable Support Mechanism). Additionally, Energy Exchange Istanbul publishes information on price and capacities of the commodities traded on its transparency platform.

In 2020, total matching quantitiy was 181.36 TWh in the day ahead electricity market.

Wholesale Electricity Markets

As a part of the transition to liberal and competitive energy market model, day-ahead, intraday, and balancing power markets were established to provide market participants a trading platform based on integrity, transparency, and competition. Day-ahead and intraday markets are operated by the independent market operator Energy Exchange Istanbul, and the balancing power market is operated by the transmission system operator Turkish Electricity Transmission Corportaion (TEIAS). All three markets are subject to regulation of EMRA.

The Day-Ahead Market

The day-ahead market is the main platform where the bulk of electricity trade takes place and the hourly market clearing price for the following day is reached. Imbalance settlement period is one hour. Market participants can place bids to balance the market positions of their portfolios and existing bilateral contracts. Bids can be hourly, flexible, mostly block-type (3 hours minimum) and lot size is 0.1 MWh. Energy Exchange Istanbul applies a price finding algorithm to match bids and provide a solution where total consumer and producer surplus is maximized.

Also, Energy Exchange Istanbul has opened the Physically Settled Power Futures Market on June 2021 which was designed to be a continuous trade platform, enabling market participants to hedge their positions in order to protect themselves from market price fluctuations and anticipate futures price expectations.

Power Futures Market (PFM)

Power futures market enables market participants to manage or hedge, price risks in a competitive electricity market. Futures contracts are legally binding that call for the future delivery of electricity.

With EXIST’s PFM, market participants have the opportunity to hedge the price risk and see the future price expectations by fixing their buying or selling prices against future price changes. For the transactions made, EXIST provides central counterparty service and guarantee to the physical delivery and payments related to the trade. The daily benchmark price (GGF) published at the end of each session for each contract open to trade on PFM, will create a price signal for the market participants and investors. The resulting price signal will contribute to investments and long-term supply security.

“Renewable Energy Guarantees of Origin System (YEK-G) & Organized YEK-G Market”

“Renewable Energy Guarantees of Origin System (YEK-G) & Organized YEK-G Market” is designed to monitor all processes of the generated electricity from the producer to the consumer by utilizing the blockchain technology entirely through EXIST’s own means.

The characteristics of each 1 MWh of renewable energy supplied to the network by the licensed generation facilities in the system will be recorded and documented.

Through the YEK-G Certificate, which has the status of an “identity card” for renewable energy, it will be monitored, proved, and disclosed that the energy used by final consumers is generated from renewable energy resources. Thus, the supply of electric energy generated from renewable energy resources to consumers will be guaranteed.

YEK-G system has been operational since June 2021.

Intraday Market

The intraday market has been set up to supplement the day-ahead market and to enable continuous trading close to real time. It serves as an additional trade platform for market participants to balance their positions and avoid imbalance charges. Bids can be hourly or block-type and the market operates on a first-come first-served basis, where bids of the participants, having the highest buying price and lowest selling prices, are matched.

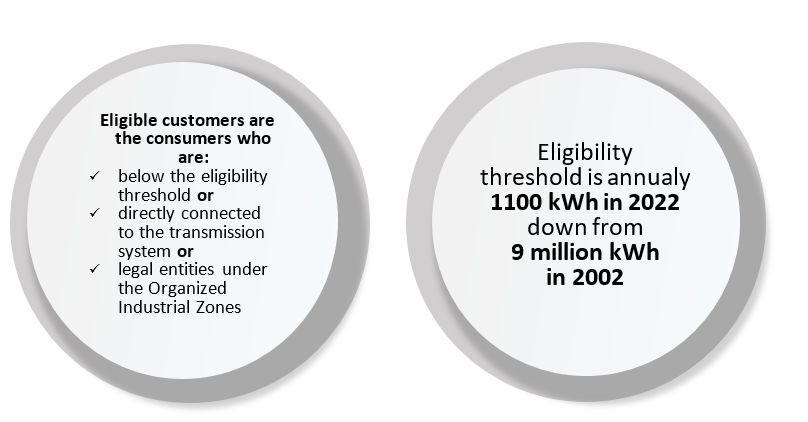

Last Resort Supply Tariff

Last Resort Supply Tariff is applied to those who are non-users of their eligible consumer rights. The main goal of this application is to form and guarantee the development of a free market. In this vein, Last Resort Supply Tariff has been applied to consumers whose annual consumption exceeds 50 GWh for 2018, 10 GWh for 2019 and 7 GWh for 2020, and 50 GWh for residential consumers and 7 GWh for other consumers in 2021, and 50 GWh for residential consumers, 7 GWh for agricultural consumers and 3 GWh for other consumers in 2022.

Balancing Power Market

The balancing power market is operated by TEIAS to balance power supply and demand in the system and to provide system security. “Balancing units”, with at least 10 MW capacity and the ability to alter generation within 15 minutes, have to participate in the balancing power market. Loading and deloading bids are evaluated by TEIAS, and the system marginal price is found by the net volume and direction TEIAS’s orders. The market works on the marginal pricing principle and TEIAS has the right to skip bids and accept less price-suitable bids in a pay-as-bid manner based on location, demand, and the participants’ prior actions.

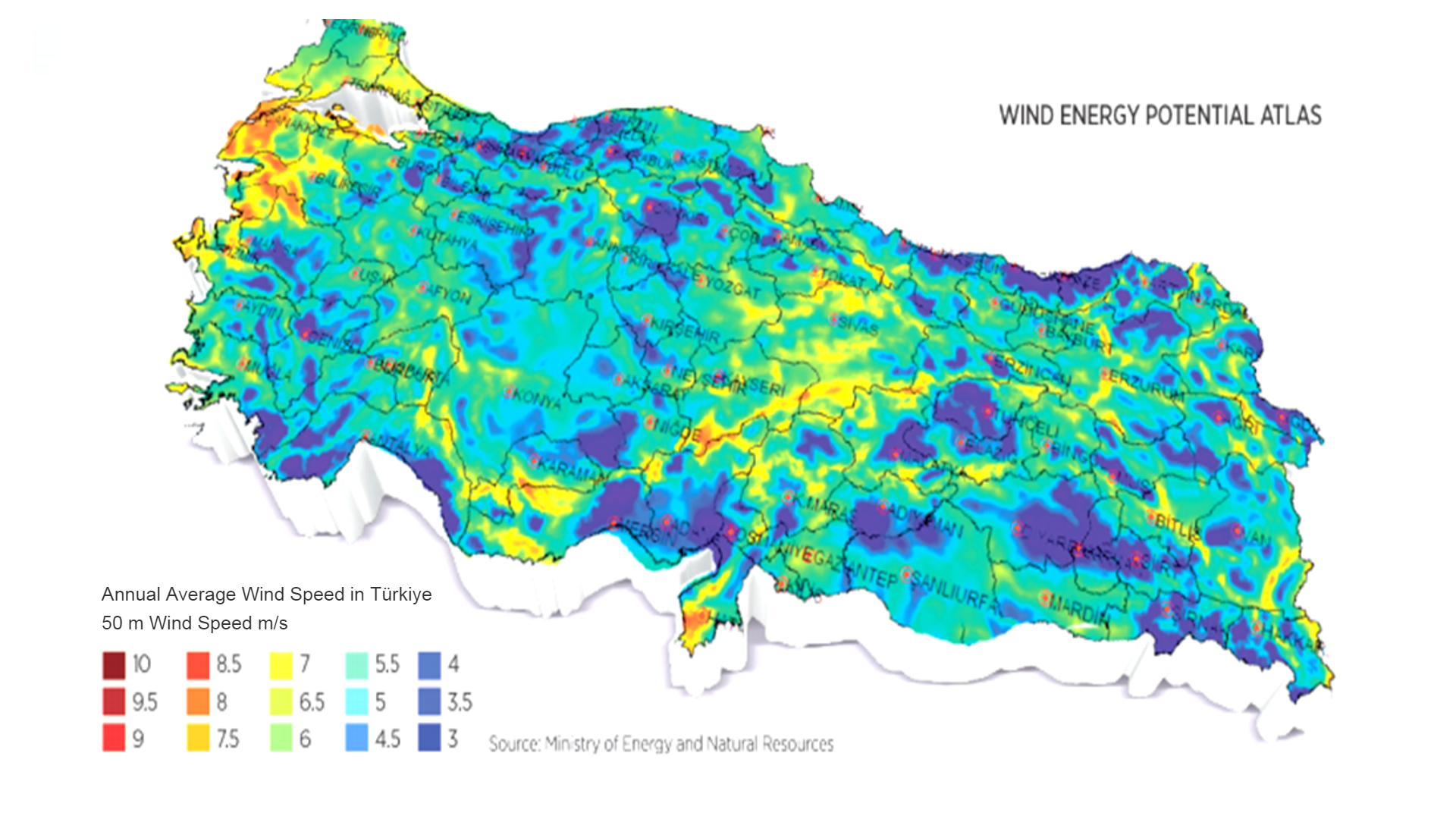

Making full use of the renewable potential is at the top of Türkiye’s agenda, and the potential is still to a large extent untapped. As of December 2021, Türkiye’s installed wind capacity is about 10.54 GW and around 2.07 GW of licensed wind capacity is under construction. On the other hand, Türkiye has an onshore wind potential of 37 GW and a completely untapped offshore wind potential of 11 GW.

With the establishment of the Clean Energy Research Institute (TEMEN), one of TENMAK's affiliate institutes, it is aimed to meet the R&D needs of our country in the fields of energy efficiency with products and technologies in processes for clean energy generation from all energy sources, especially renewable energy sources, and to develop domestic products and technologies in this field.

And with the establishment of the Energy Research Institute (ENAREN), one of TENMAK's affiliate institutes, it is aimed to meet the R&D needs in the product and technology areas in the production, transmission, distribution and consumption processes of our country's energy resources and to develop domestic products and technologies.

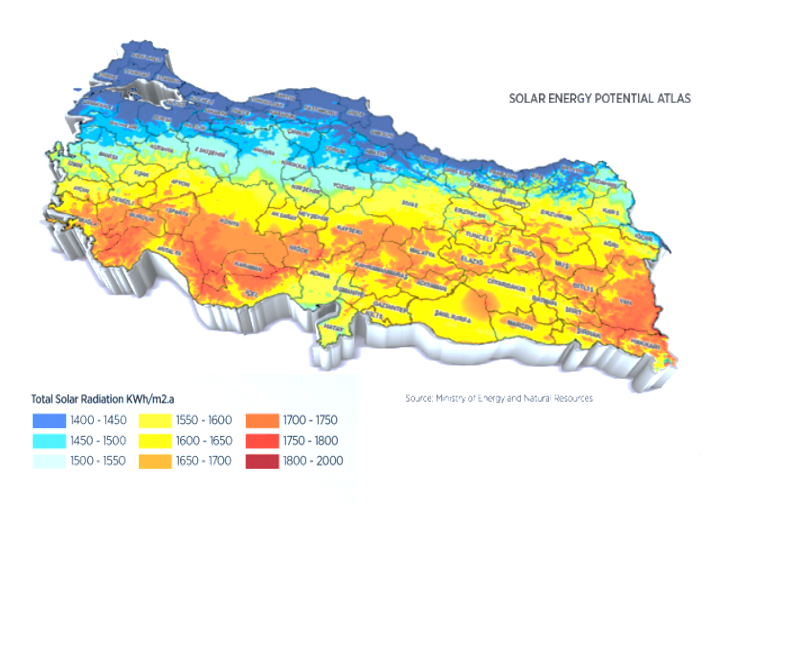

As for the solar potential, annual average daylight duration in Türkiye is 7.5 hours and average annual radition is 1527.46 kWh/m2, which is greater than most of Europe. Türkiye’s installed solar capacity is only around 7.8 GW as of the end of 2021, although solar power potential in Türkiye is nearly twice the size of Northern Europe’s.

The effort to invest in RE will lead to growing demand for RE equipment such as turbines and photovoltaics (PV) panels. Türkiye will continue to incentivize localization through providing bonuses for locally manufactured equipment.

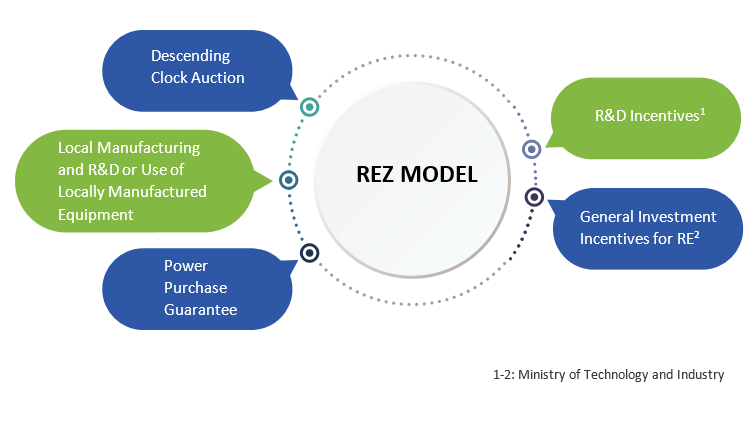

Renewable Energy Zones (REZ) Model

The REZ model was created by Türkiye in order to ensure efficient and effective use of RE resources by setting up large scale REZs in selected areas. The model was designed in a way that also serves to help attain the localization target set in the National Energy and Mining Policy. The REZ model is granted the right to generate and sell the electricity at a price determined as a result of the process. The tender involves the condition of the establishment of local manufacturing and R&D facilities or using locally manufactured equipment with an aim to ensure localization. The REZ model is crucial for Türkiye as it is a tool for fast tracking the realization of planned projects and technology transfer.

Türkiye has been gearing up its RE investments, and one of the tools Türkiye employs to this end is the REZ tenders. In 2017, Türkiye held two enders for solar and wind energy with 1 GW capacity each by using REZ auction. In 2019, a new wind tender covering 4 regions with a total installed capacity of 1 GW was completed. Türkiye’s track record of REZ tenders including the recent announcements are as follows:

The Main Advantages of Renewable Energy Zone Tenders

- Resource abundant zones with high electricity generation potential are selected as REZs. As the projects are large scale (around 1 GW), the winner is expected to benefit from economies of scale.

- The winner is granted a fixed and foreseeable price for its generation for a fixed duration. (The first tenders involved a power purchase guarantee for a period of 15 years or duration that is limited to amount of total electricity genaration defined in tender announcement). The winner is granted the right to use the designated area and grid connection capacity.

- If the tender involves an R&D facility, it is eligible to benefit from the incentives provided for R&D centers. Other incentives envisaged in Türkiye’s incentive system may apply to plants and/or the manufacturing facility.

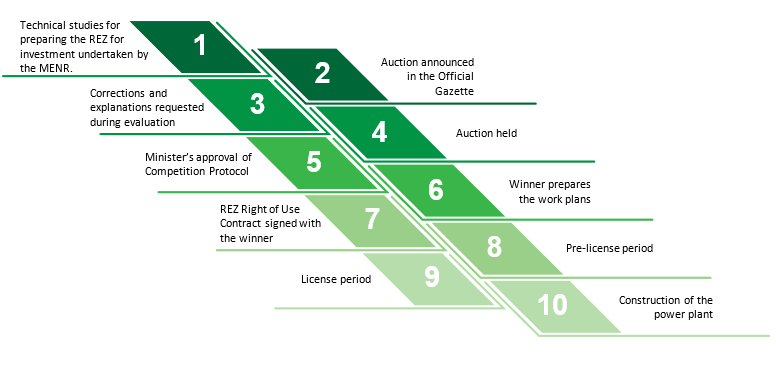

1 REZ is determined

The first step of the REZ model is determining the resource zones. Either REZs are identified directly by MENR or zones are ascertained in cooperation with the tender winner following the allocation of grid connection capacity for REZs by MENR.

2 Tender announcement is published

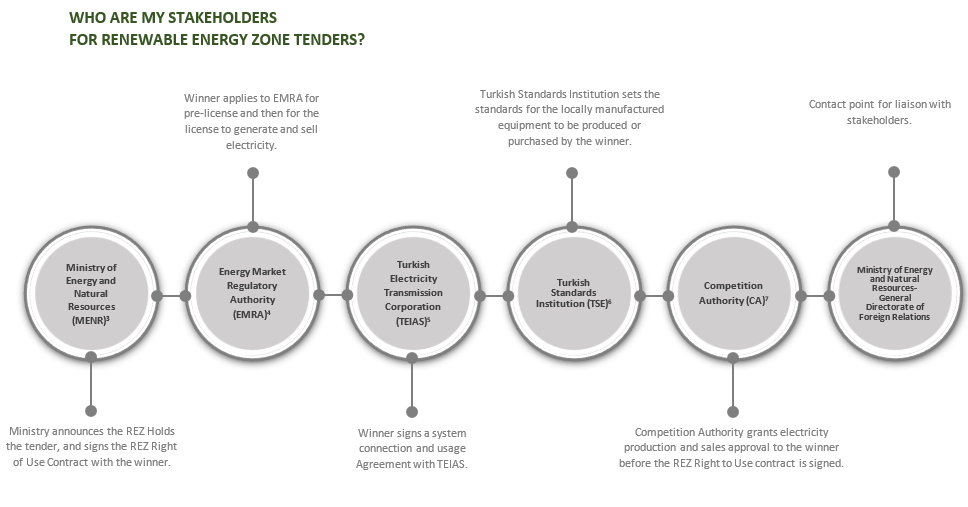

The “REZ Right of Use Competition Announcement” is published in the Official Gazette. The announcement includes technical details of the zone, administrative conditions, grid connection capacity, eligibility criteria, upper limit for the power purchase price, the envisioned duration of power purchase, etc.

3 Evaluation is carried out

A committee established for evaluation reviews of the application documents submitted by applicants. Applicants may be asked to correct their application or provide more information. Applicants who passed the evaluation are invited to the tender.

4 Tender takes place and winner is determined

All eligible applicants particate in a descending clock auction. In each step applicants are asked if they are willing to decrease their bidding price to a price below that of the lowest bidder. Those who do not decrease their bidding price are assumed to have withdrawn. At the end of the competition session, all participants but the winner are considered withdrawn from the competition.

5 The result of the auction is approved by the Minister

Upon completion of the auction, the Committee prepares a protocol outlining the results of the auction which is in turn approved by the Minister. After this approval, winner can obtain the Letter of Bank Guarantee submitted during the application.

6 Winner outlines its work plan

The work plan includes the expected time for the establishment of generation facility and commissionning date.

7 REZ Right of Use Contract is signed with the winner

After the contract, the winner starts the studies to propose the candidate REZs. Following the evaluation of MENR, REZs are published in Official Gazette and the winner applies for pre-license.

8 Winner applies for pre-license

The winner is exempt from submitting a wind or solar measurement report. The main responsibilities of the winner during this process are: (i) approval of zoning permits, (ii) preliminary project approvals, (iii) system connection and system usage agreement with TEIAS, (iv) construction permit, and (v) environmental impact assessment decision.

9 Winner applies and is granted a license

In order to obtain a license, the winner is expected to submit documents to Energy Market Regulatory Authority showing (i) that the applicant has completed all responsibilities during the pre-license period, (ii) timeline of construction, (iii) that minimum share capital is deposited, license fee is paid, letter of bank guarantee is obtained, etc.

10 Winner can start the contruction of the power plant

After getting license, the winner has to complete the installation of power plant in construction period which is defined in REZ Right of Use Contract.

How can I learn about the upcoming tenders?

Tenders are announced in the Official Gazette (www.resmigazete.gov.tr) at least 30 days before the application deadline as well as on the MENR’s website (www.enerji.gov.tr). Terms of reference documents can be obtained from the MENR’s website (www.enerji.gov.tr).

What is the duration of the electricity sales?

Who buys the electricity?

Duration is identified in terms of reference. It was 15 years in the past 4 tenders. Duration is limited to amount of electricty production for YEKA RES-3 and YEKA GES-4. Winner sells the electricity to the YEKDEM mechanism.

Who can apply to participate in a REZ tender?

Those who satisfy the conditions set in the REZ Regulation and the terms of reference are eligible to apply. If there is to be any prerequisite of being legal person, a joint venture or a consortium, this is also ascertained in the terms of reference. The winner has to satisfy the conditions set for the legal persons in the By-Law for Electricity Market Licensing (date: 2/11/2013 O.G. No: 28809) to be able to obtain a pre-license.

Is the winner required to set up a factory and/or undertake R&D activities?

If the tender is conducted using the allocation in return for Locally Manufactured Equipment (and not for using local equipment) method, the winner is required to set up a factory and undertake R&D activities.

For how long is the REZ license?

Is it possible to extend this duration?

The duration of the REZ license is set in the terms of reference. It is not possible to extend this duration.

What happens if the winner decides not to sign the REZ Right of Use Contract?

The letter of guarantee submitted by the winner during the application is recorded as revenue. MENR might invite the 2nd or 3rd lowest bidders to sign the contract.

Does the winner have to install a power plant with an installed capacity equal to the grid connection capacity?

The minimum installation requirement of the allocated grid connection capacity is determined in the terms of reference.